Richer hospitals aren’t pulling their weight in charity care, study finds

Charity care, also known as financial assistance, refers to free or discounted care that a hospital provides to low-income patients. Nonprofit hospitals are required to provide charity care as well as other community benefits, to maintain their (very valuable) tax-exempt status. However, community activists and researchers have questioned whether some nonprofit hospitals are doing enough for their communities to warrant these costly tax benefits.

In a recent research letter in JAMA Internal Medicine, Johns Hopkins professor of health policy and management Ge Bai and colleagues examined trends in the provision of charity care across nonprofit hospitals in 2017. Here are a few highlights from their analysis:

- Many nonprofit hospitals are not making a profit. Among the 2563 hospitals with available Medicare cost reports, only the top quarter had positive net income in aggregate. The top 5% of hospitals (128 hospitals) made about half of the income of all hospitals in total.

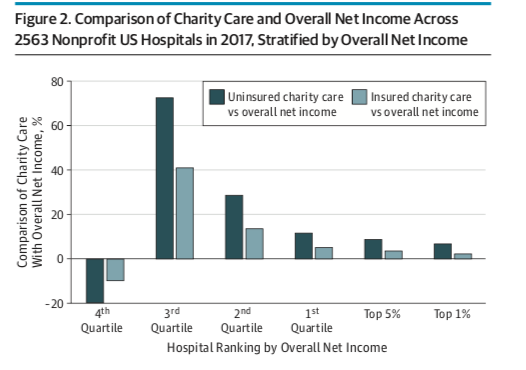

- Hospitals making the most money are spending less than poorer hospitals on charity care, as a share of income. Hospitals in the top quartile of net income spent less than 20% of their net income amount on charity care; hospitals in the second quartile spent more than 40% of their net income on charity care; and hospitals in the 3rd and 4th quartiles spent much more than they made in net income on charity care.

- Despite not making a profit, “poorer” hospitals are still spending considerable amounts on charity care. Hospitals in the bottom quartile accounted for nearly 20% of the total amount of charity care spent by non-profits in 2017.

- Hospitals in states that expanded Medicaid provided less charity care than in other states. This suggests that hospitals in Medicaid-expansion states are not adjusting their financial assistance policies to expand charity care to insured people who may need assistance.

The authors note that nonprofit hospitals are allowed to craft their own financial assistance policies, and can make them more or less inclusive. The freedom to decide who gets charity care makes a huge amount of difference in how much hospitals spend on financial assistance.

“Nonprofit hospitals with substantial financial strength should consider more generous financial assistance eligibility criteria to reduce the financial risk exposure of disadvantaged uninsured and underinsured patients,” the authors write.

Another avenue for change would be additional regulation of charity care policies. Perhaps it is also time for the IRS and other regulatory bodies to mandate a certain level of charity care spending relative to net income, or —as the state of Oregon has done–pass legislation to create a “community benefit spending floor” for hospitals based on their profit levels.